Insurance Planning

Life insurance

Life insurance example

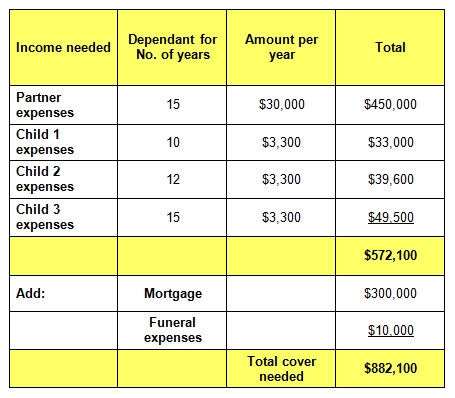

The diagram shows the first method that can be used for calculating life insurance. This is a simple needs-based calculation to determine the total cover needed.

This example doesn’t take into consideration any other assets you have and doesn’t include investment earnings. For example, if $200,000 of superannuation was held, then the total cover needed may reduce to $682,100.

This example also assumes your partner will start working after the youngest child has left home after 15 years and that his/her earnings will fund all expenses from that time on.

This example doesn’t take into account inflation. Inflation is an important factor as the cost of living will increase over time. In addition, the lump sum received initially might be invested and therefore the earnings could assist with some of the expected expenses.

You may also want to build in a buffer for unexpected expenses that may arise.