Cashflow and Compounding

Identifying your path on the Financial LifeCycle

Types of financial independence

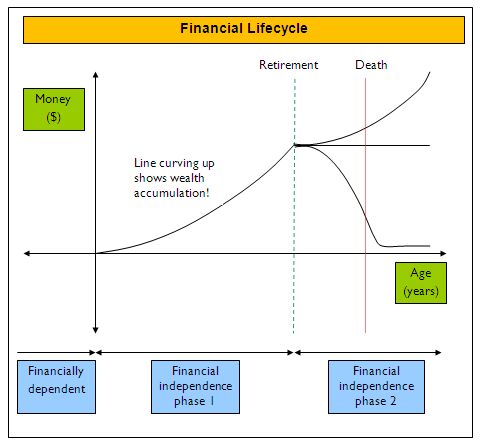

As shown in the bottom part of the Financial Lifecycle diagram, and in its simplest form, our financial lifecycle has three phases.

You tend to move from being financially dependent on your parents or guardians, to an employee where you become financially independent, in the sense that you earn an income which is hopefully greater than your expenses.

As time passes, the source of income tends to transition again, with a greater amount coming from business and investment. As you increase the income you receive from investments, and for some, from private business, you become less and less reliant on generating income through your employment or self-employment.

Once you reach this financial position, retirement becomes a genuine option. In fact, retirement is very much a cashflow concept these days, and with adequate cashflow you can retire at any age. In saying that, many people who have adequate funds to retire continue to work, hopefully in an area which is enriching and engaging to them.