Investments

Investment risk profiles

Portfolio weightings

Asset classes may have differing returns from year to year.

Over time this results in the portfolio moving away from the percentage originally allocated for each asset class.

This makes it important to regularly review where the portfolio is invested and make changes if necessary.

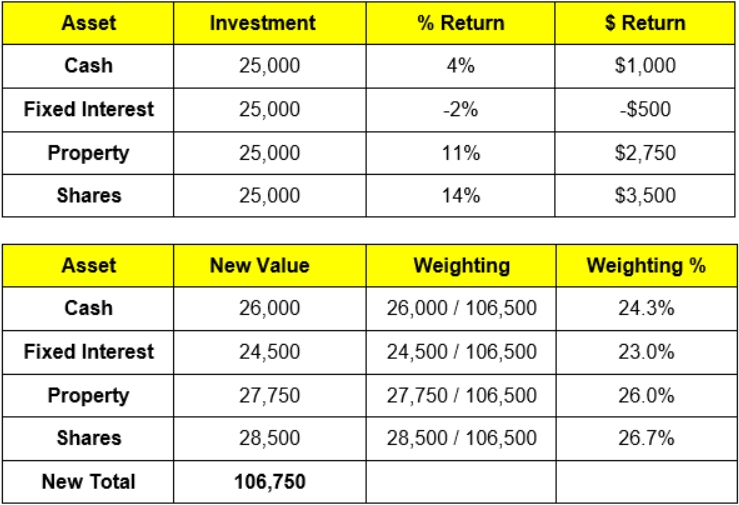

Let’s look at the way returns can alter the weighting of your portfolio. A balanced asset allocation is shown in the top table, with the hypothetical returns for the previous year.

Note: The negative return on the fixed interest investment might be due to a fall in bond prices.

The second table adds the returns to the asset class that derived the return (i.e. reinvesting), and shows the new portfolio weightings. Overall the portfolio achieved a combined return of 6.75%. However the asset classes performed differently to contribute to this overall return. As a result, your portfolio weightings have changed and may need reviewing.