Superannuation

Contributing to Superannuation

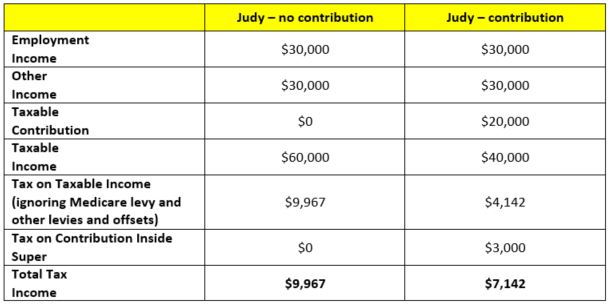

Example of saving tax

If Judy did not make any contribution, her taxable income (assuming no other deductions) will be $60,000, on which she will pay tax of $8,788 (plus a further $1,200 for the 2% Medicare Levy).

However, when she makes a $20,000 concessional superannuation contribution, her taxable income reduces by $20,000, saving her $5,300 in personal tax (and $400 on the Medicare Levy).

However, the super contribution will attract contributions tax of 15% in the fund, being $3,000. Therefore, the overall net tax saving in this scenario is $2,300 (being $5,300 less $3,000). There is also an additional $400 saving on the Medicare Levy. The balance of the concessional contribution after tax of $17,000 will form part of the taxable component of Judy’s super account and further tax could be payable when withdrawn at retirement (if she is under age 60 at the time or the amount is paid to any non-tax dependants upon her death).

| Judy – no contribution | Judy – contribution | |

| Employment income | $30,000 | $30,000 |

| Other income | $30,000 | $30,000 |

| Taxable contribution | $0 | $20,000 |

| Taxable income | $60,000 | $40,000 |

| Tax on taxable income (ignoring Medicare levy and other levies and offsets) | $8788 | $3,488 |

| Tax on contribution inside super | $0 | $3,000 |

| Total tax income | $8,788 | $6,488 |