Cashflow and Compounding

Using your personal financial statement

Building your PFS

7. If you are an employee and receive a wage, you can include your after tax income.

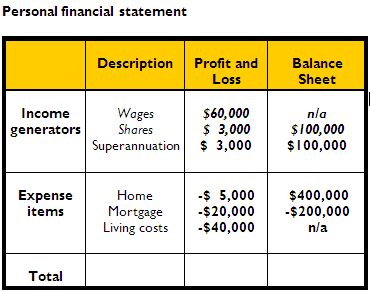

The Personal Financial Statement shows this for someone who earns $60,000 per annum after tax.

We suggest that all of your financial information and projections into the future, consider tax and fee implications.

To learn more about tax implications, go to the Tax and Structures module.

8. If you have some share investments, you can include these as well.

The Personal Financial Statement shows a share portfolio worth $100,000 with $3,000 income (or 3% income return).

Page 26 of 49