Debt Management and Leverage

Gearing into investments

Positive and negative gearing

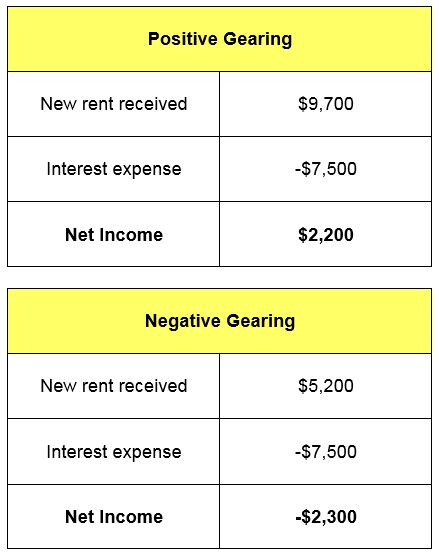

Positive Gearing

This is where the income from the investment is higher than the expenses for the investment. This creates a positive cash flow. An example based on a geared residential property is opposite.

The net income is then included in your taxable income for the year and subject to tax.

Negative Gearing

This is where the expenses for the investment are greater than the income it produces. This means that the investment is providing negative cash flow. An example based on a geared residential property is opposite.

Depending on your taxation situation, you may be able to reduce other taxable income by this loss. You will need to use some of your other money to meet the costs of the investment.

These examples of cash flow ignore growth or loss in the investment value.