Debt Management and Leverage

Negative gearing and capital gains

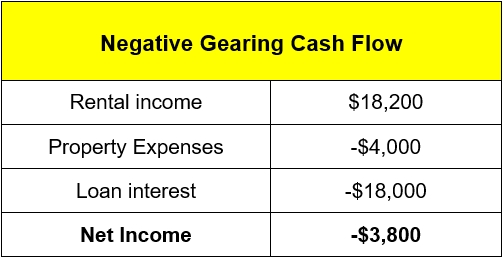

Cash flow example

Let’s say, you have an investment property worth $500,000 and an interest only loan of $400,000 with an interest rate of 4.5% p.a.

You receive rent of $350 per week and have property expenses of $4,000 p.a. Your cash flow for the investment property is shown in the table.

You earn $105,000 p.a. and you are in the 32.5% marginal tax rate bracket, plus the Medicare levy (see Tax and Structures module).

You can reduce the tax on your other taxable income by the loss from this investment property.

As your marginal tax rate is 32.5%, your tax is reduced by $1,235 (32.5% of $3,800).

Therefore your loss after tax is $2,565 ($3,800 – $1,235). Allowing for Medicare saving may reduce this loss further.

This is the amount you are out of pocket.

Page 31 of 46