Debt Management and Leverage

Using home equity to build investments

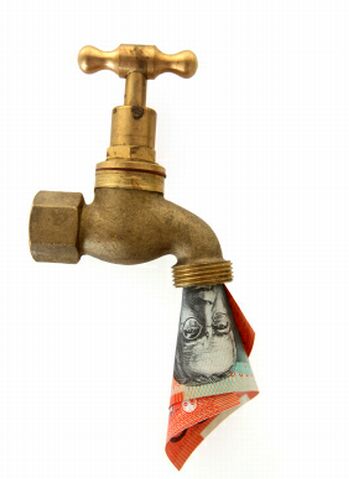

Cash flow

In such a strategy, it is really important that cash flow implications are reviewed. Using your home to purchase another property creates new cash inflows and outflows, which can increase risk.

Cash inflows could include rent received from the investment property. The outflows will include the interest payments and expenses (including tax) of the investment property. The net cash flow is the cash inflow less the cash outflow.

It is possible that a net cash outflow will arise. Cash flow outcomes are discussed later in this module.

In a similar way, you could also use the $300,000 available equity you have in your home to purchase shares or managed funds. This could be achieved by establishing a new loan account secured by your home to enable you to borrow and invest in other investments.

Later we will explore other borrowing arrangements that can be used to invest.