Debt Management and Leverage

Gearing into investments

Second gearing example

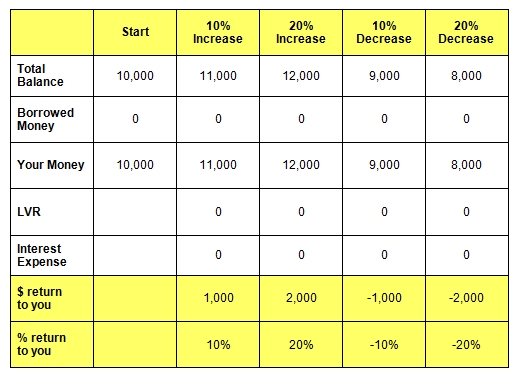

We will now demonstrate the outcomes of gearing versus non-gearing.

The following two examples show the outcomes of changes in portfolio values, and what this means to overall performance.

The assumptions for the examples are that:

- the return to you is the increase in your money less interest and costs, with an interest rate of 8%

- no consideration has been given for potential tax benefits from negative gearing

- the Loan to Valuation Ratio (LVR) is the loan divided by the portfolio value

- the gearing ratio is worked out by dividing the borrowings by your money.

This example shows an investment of $10,000 with no borrowed monies. The example on the following page shows what happens if we combine our cash with some borrowings.

Page 22 of 46