Superannuation

Contributing to Superannuation

Concessional v Non-Concessional Contributions

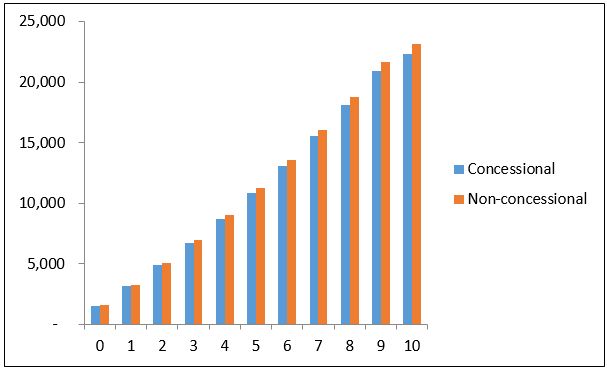

If you compared this strategy over 10 years, assuming an effective earning rate of 7% p.a. after tax and fees and contributions are made in advance each year;

- Under option 1 you would have $20,881 additional superannuation (after tax); and

- Under option 2 you would have $20,469 additional superannuation.

This does not take into account any superannuation guarantee that may be payable or the increases in the contribution levels. It also assumes no changes to personal taxation rates nor eligibility to the super co-contribution.

This simple example demonstrates why it is important to compare different scenarios and options and seek professional advice, particularly as your income changes. The results will vary for different income levels.

Page 47 of 95