Superannuation

Superannuation Retirement Income Streams

Account Based Income Streams

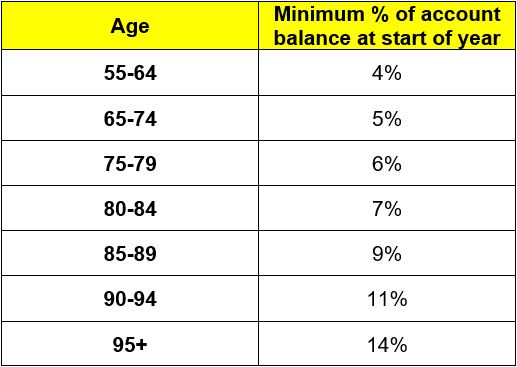

The minimum annual amount of income payments you must take from account-based income streams is based on your age, as outlined in the table [CW1] opposite. As previously stated, there is no limit to the maximum income that can be withdrawn.

Let’s say, you have $300,000 in your account-based pension at age 60, which has a minimum of 4% drawdown, and it is invested in cash earning 5%. As you are withdrawing less than the annual earnings, your account balance will continue to increase slightly.

If, however, you took a higher amount than the minimum, say $30,000 pa, the amount of income withdrawn would be greater than the annual earnings and accordingly your account-based pension balance will be depleted in around 15 years.

Page 62 of 95