Superannuation

Withdrawing from Super

Withdrawing a Lump Sum

Upon satisfying a condition of release, a member has various options with their super account:

- Withdrawing a lump sum

- Transferring funds into a retirement income stream (pension) and withdrawing a regular pension

- A combination of taking a part lump sum and rolling the balance across into a pension product

- Leaving the retirement funds in the member’s superannuation account. Funds can be held indefinitely in a superannuation account (accumulation phase).

Withdrawing a lump sum

If your money in super is withdrawn in the form of a lump sum payment prior to age 60, tax may be payable on the benefits. Any lump sum withdrawals from age 60 are completely free of tax.

There are two components that a members account will typically consist of: a tax free component and a taxable component. The tax payable on any lump sum withdrawal is dependent upon the taxable component withdrawn and your age. The tax-free component is always tax free when withdrawn.

Super lump sum payments from a super fund must be taken proportionately with each payment potentially comprising both a taxable component and tax-free component depending upon the contributions paid into the fund over the years. So, if 10% of your super benefit is a tax-free component, then any lump sum withdrawal from your fund will have 10% as a tax free component and the remaining 90% will be a taxable component, whether you withdraw $100 or $100,000. This is known as the ‘proportional rule’.

You will never pay any tax on your tax-free component, however tax may apply to your taxable component based on your age and the amount being withdrawn. The tax-free component is made up of your total non-concessional contributions paid into your account over the years prior to retirement. The taxable component is the balance of your account balance consisting of all concessional contributions, which were subject to a tax deduction, and earnings generated over the years.

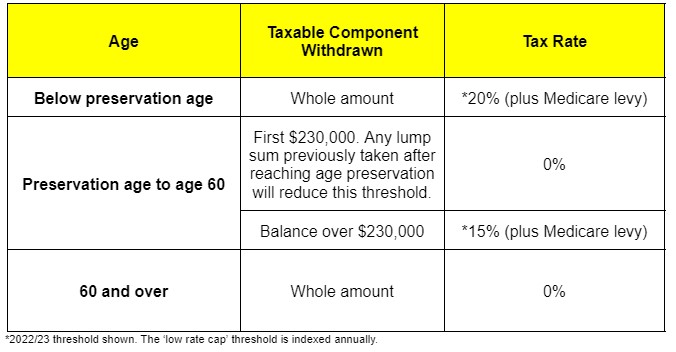

The table below shows how the taxable component is treated for lump sum withdrawals from a taxed superannuation fund. As shown in the table, once a member turns 60 years of age, both the tax-free and the taxable component are tax free when able to be withdrawn. Where a member is aged between preservation age and under 60, the taxable component withdrawn as a lump sum is taxable, but a member will be eligible for a low-rate cap of $245,000 for 2024/25 year. This means that the first $245,000 of the taxable component of the amount withdrawn will be exempt from tax. The low-rate cap of $245,000 is a lifetime cap and reduced by any earlier taxable lump sum withdrawals.

| Age | Taxable component withdrawn | Tax rate |

| Below preservation age | Whole amount | *20% (plus Medicare levy) |

| Preservation age to 60 | First $245,000. Any lump sum previously taken after reaching preservation age will reduce this threshold | 0% |

| Balance over $245,000 | 15% (plus Medicare levy) | |

| 60 and over | Whole amount | 0% |