Cashflow and Compounding

Using your personal financial statement

Building your PFS

6. In regards to your superannuation, the investments within your superannuation fund are likely to be producing income. This is regardless of whether you are receiving a payment from your superannuation fund or not.

You can include the income return in the cashflow column. However, don’t include this when you total up your net cashflow position.

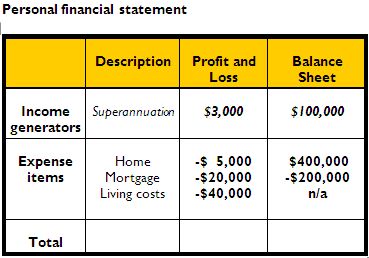

In the following table, we have put in a superannuation balance of $100,000 and an after tax income return of $3,000 or 3%.

When projecting your future balances, add the income return, your contributions and the expected capital growth on to the balance.

(This is getting technical, so if it is confusing, read both the Investments and Superannuation modules, and then come back and re-read this section.)

The Personal Financial Statement on the right shows the above information entered.