Debt Management and Leverage

Negative gearing and capital gains

Reviewing capital gains

Let’s work out what the tax payable on the capital gain is.

The tax you pay on your normal income of $105,000 of income is $24,592 (for 2023/24 tax rates), plus the Medicare levy.

The tax on the new taxable income of $302,500 is $106,792 (for 2023/24 tax rates), plus the Medicare levy. So the tax payable has gone from $24,592 to $106,792, therefore the tax on the capital gain component is $106,792 less $24,592 – which is $82,200, plus Medicare.

So the total capital gains tax is $82,200.

And your net gain after tax (but ignoring Medicare) is approximately $312,800, which is $395,000 (your gross capital gain) less tax of $82,200.

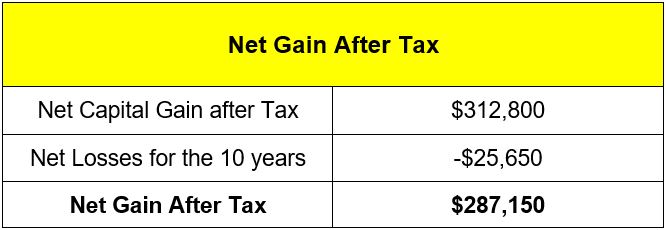

The net amount you have made after tax for the whole 10 years is shown in the table.

Net gain after tax

| Net capital gain after tax | $315,025 |

| Net losses for the 10 years | -$26,600 |

| Net gain after tax | $288,425 |

This will take you into a higher marginal tax bracket and you need to think about what else might be affected by this change (e.g. Medicare Levy Surcharge).

Please note, this is not a real life example. And it is only one way to evaluate a gearing strategy. Also, to avoid further complicating this calculation, we have not considered inflation, or the time value of money, which can have a significant impact on the outcomes.