Debt Management and Leverage

Using home equity to build investments

You could use some or all of this equity in your home to purchase other investments.

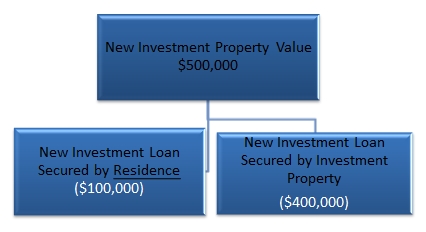

For example, you could use some equity to buy an investment property. Assuming this second property has the same value ($500,000), and the bank is willing to lend you 80% of its value, which is $400,000.

Therefore to purchase the second property you need $100,000 as a deposit.

Given you have $300,000 of equity in your own home, you could borrow $100,000 secured by your existing home to help fund your new property.

You now have $600,000 of total debt ($100,000 personal which was used to buy your home and $500,000 investment which was used to buy the second property), and a total property value of $1,000,000.

Page 17 of 46