Self-Managed Super Funds

Insurance Considerations

SMSF insurance structuring

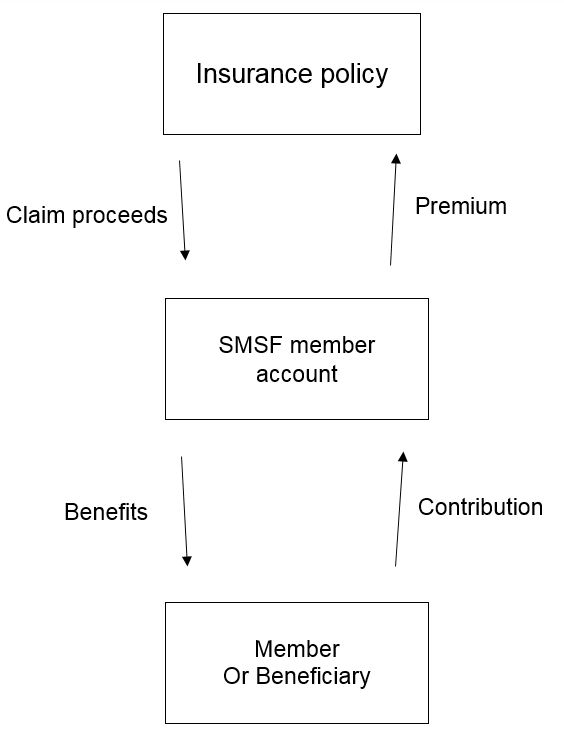

Where insurance policies are owned by an SMSF on behalf of a member, the SMSF trustee is named as the policy owner and the member is the life insured.

In most cases the cost of the premium taken out on behalf of a member is deducted from the member’s super account. The trustee may be able to claim a tax deduction for the cost of the premium. In the event of a successful claim, insurance benefits are paid by the insurer to the trustee of the super fund and are generally added to the member’s account to form part of the member’s total superannuation benefit. The trustee of the super fund then needs to determine whether the member has satisfied a condition of release to be able to access the funds. But other strategies and structures may be set up.

The structure of the insurance arrangement and flow of money is shown in the diagram.