Self-Managed Super Funds

Investment decisions and rules

Bank account

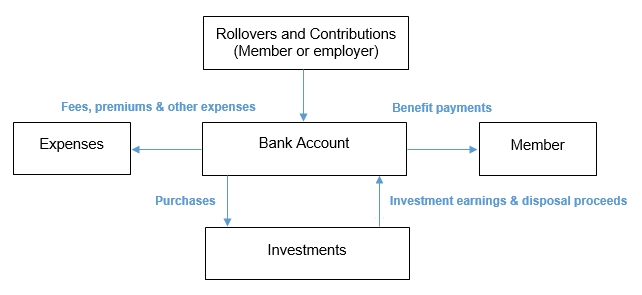

An SMSF will need a bank account (to manage the fund’s operations). All cash contributions, investment earnings and rollovers should be paid into this account. The money can then be invested according to the fund’s investment strategy and used to meet the fund’s expenses and liabilities.

There only needs to be one bank account for the fund (although there can be more than one). The fund doesn’t need to have separate bank account for each member. In the accounting records for the fund the Trustees need to keep a separate record of each member’s entitlements (called a member account).

The flow of transactions is shown in the diagram opposite.

Page 28 of 61