Self-Managed Super Funds

Investment decisions and rules

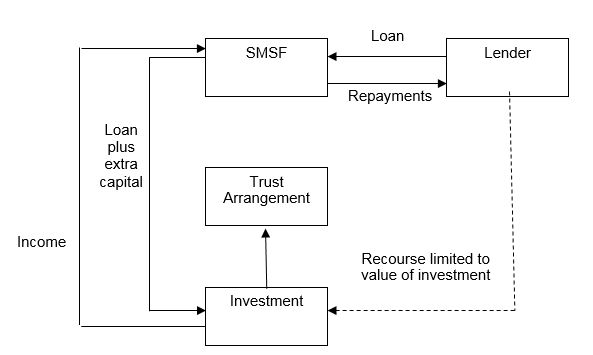

Limited recourse borrowing

Whilst a SMSF is generally prohibited from borrowing, a SMSF is permitted to borrow funds under a limited recourse borrowing arrangement (LRBA). The LRBA rules are complex and must be strictly adhered to. It is generally advisable to engage a financial adviser or legal professional to help with setting up these arrangements.

To summarise the rules:

- The money borrowed must be used to acquire a single asset or a collection of identical assets that have the same market value as each other and are traded together as a collection (e.g. one property or a collection of shares in the same company).

- The asset must be held in a separate trust (bare trust) until fully paid off.

- If the trustee defaults on the loan, the amount that can be recovered by the lender is limited to the value of the asset held in the separate trust.

- The money borrowed can be used to make repairs to the asset but the money borrowed cannot be used to make improvements (i.e. renovations, extensions or any other material change cannot be made to asset).

- The loan must be on commercial terms if a related party is the lender.

Please note: Repayments from limited recourse borrowing arrangement will cause a credit to your super transfer balance account. These credits increase your transfer balance account and reduce your available personal cap space. Importantly, this applies to a limited recourse borrowing arrangement established under a contract entered into on or after 1 July 2017. Furthermore, refinancing a pre-1 July 2017 limited recourse loan may also remain exempt from this change if certain criteria are met.