Superannuation

Contributing to Superannuation

Concessional v Non-Concessional Contributions

Option 2 – contribute to super after tax

- A total of $5,000 is contributed by you to super as a non-concessional contribution.

- Your gross salary will be $50,000. Tax payable on this amount is $5,788 (plus Medicare).

- No tax is applicable on the non-concessional contribution to super.

- If you contribute $5,000 to super out of your own cash, you may be eligible for a government co-contribution of $346.68 (giving total contributions of $5,346.68).

- The total super balance will consist of the $5,000 non-concessional contribution plus the $346.68 of the government co-contribution.

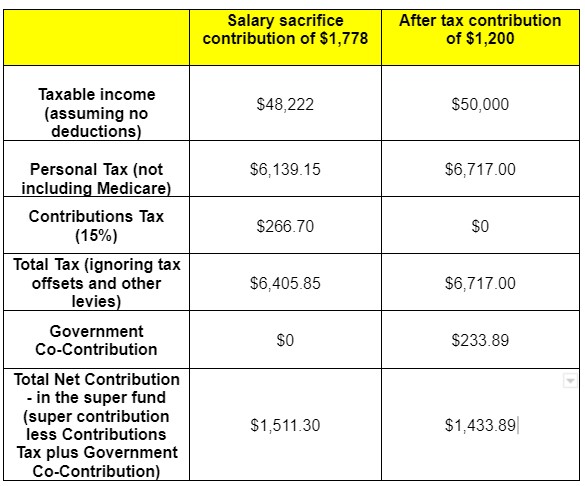

As you can see, salary sacrificing the contribution provides a saving in income tax of $1,500.00, not allowing for any Medicare levy payable or tax offsets. However, by making a personal non-concessional contribution, you are eligible for the Government co-contribution which results in a net increase in the super balance of $1,096.68. Overall, you are still better off by salary sacrificing into super, however the comparison will be different for each person, and you do need to consider your own situation.

| Salary sacrifice contribution of $5,000 | Non-concessional contribution of $5,000 | |

| Taxable income | $45,000 | $50,000 |

| Income payable (excluding Medicare) | $4,288 | $5,788 |

| Net savings in income tax | $1,500 |

| Salary sacrifice contribution of $5,000 | Non-concessional contribution of $5,000 | |

| Total super contribution | $5,000 | $5,000 |

| Less contributions tax | $750 | $0 |

| Add govt co-contribution | $0 | $346.68 |

| Total super balance | $4,250 | $5,346.68 |

| Net increase in super | $1,096.68 |

Page 46 of 95