Tax and Structures

Capital gains tax

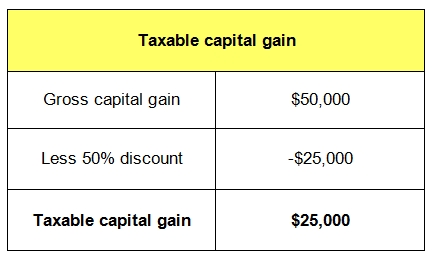

Capital gains tax example

In our previous example we assumed:

- Fred’s taxable income was $72,000.

- Fred’s gross capital gain on the property sold was $50,000 ($470,000 – net sale proceeds, less $420,000 – cost base of the property, including purchasing costs).

Let’s assume Fred bought the property in Jan 2005 and sold it in Jan 2024.

He’s held the property for more than 12 months, so a 50% discount is applied to the capital gain made. The gross accessible capital gain of $25,000 is added to Fred’s other assessable income. The other 50% of the capital gain is exempt from tax.

See the table opposite.

Page 15 of 58