Tax and Structures

Franking credits explained

Example of franking credits

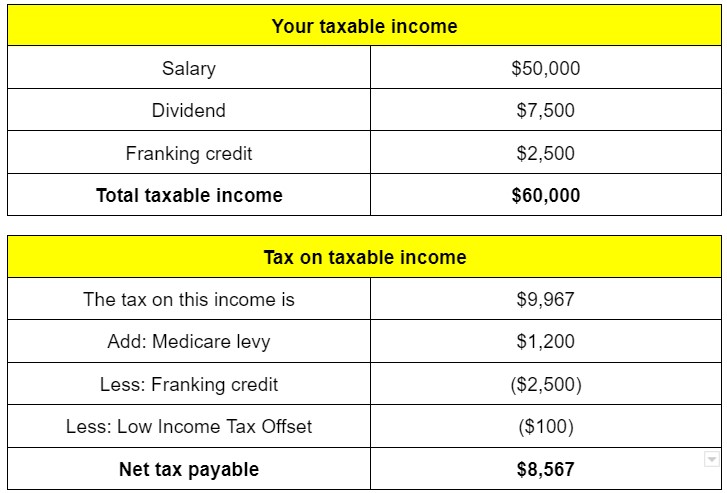

Let’s look at an example. You’re the sole shareholder of your family company which qualifies as a small business entity.

Over the current financial year you have drawn a wage of $50,000 (if this was your only income, net payable is $7,467 based on income tax of $6,717 plus Medicare levy of $1,000 less $250 for the low income tax offset).

In addition, your company made a taxable profit of $10,000 and paid $2,500 tax to the ATO (a tax rate of 25%). Your company then pays you the $7,500 left in after-tax profits as a fully franked dividend. Your taxable income for the year is shown in the table opposite.

In this example, as you’re on a higher marginal tax rate (32.5%) than the tax rate already paid by the company at 25%, you will need to pay the difference in tax on the dividend received.

Therefore, you will need to pay a further tax of 7.5%, being the difference between the company tax rate and your marginal tax rate (plus 2% Medicare levy) on the dividend received. Remember that the company has already paid $2,500 in tax.

If you were on a 19% marginal tax rate, you would be eligible to receive the difference between your marginal tax rate and the higher tax rate already paid by the company back from the ATO as a refund.

.