Tax and Structures

Comparison of all entities

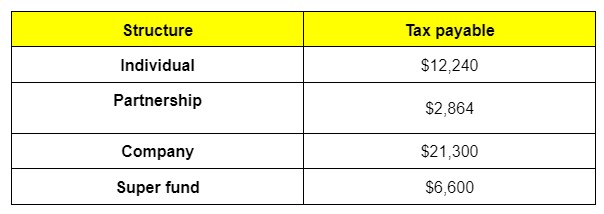

Summary of tax for all entities

In summary, using the income figures provided, the tax payable for the various tax structures are shown in the opposite table.

As you can see, there are some quite significant differences and they do vary dramatically depending upon the size and structure of income derived. While a partnership structure appears to be the most tax effective in this example, this would not necessarily be the case if the assessable income was $1 million as the partners would then each have to pay tax at the highest marginal tax rate of 45% (plus 2% Medicare Levy).

Please note that when you’re investing or structuring your financial affairs there are other important factors to consider besides tax.

Areas such as legal ownership, protection of assets, flexibility of having access to capital and what other income is being earned will all affect which structure is optimal for you.

For example, even though superannuation has attractive taxation benefits, if you’re 30 years old it may not be a good idea to put all your money in super, as you generally won’t have access to the funds until you satisfy a condition of release such as turning 65 years of age.