Tax and Structures

Trust Taxation

Tax on trust distributions

Managed funds operate in a similar way. However, these publicly offered unit trusts often have many more than ten unit holders.

Also, rather than a trustee, there is a responsible entity to oversee the fund’s assets and operations. We will explore managed funds in more detail in the Investments module.

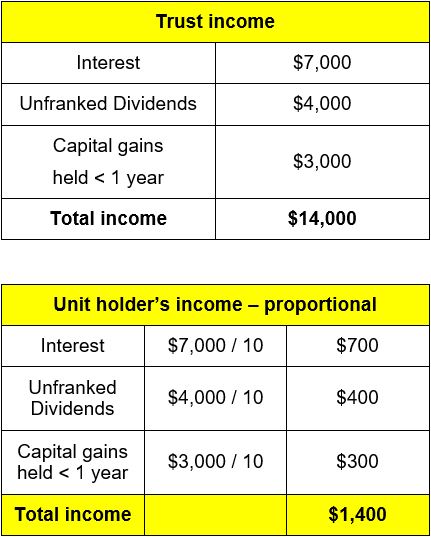

Let’s say the unit trust earned the income shown in the first table opposite for the year, which totals $14,000. Each of the ten unit holders will usually receive a proportional amount of income according to their unit holding, or 10% each in this case as shown in the second table, being a total of $1,400.

The $1,400 is added to the individual’s other income to calculate the total assessable income, although it may be adjusted for imputation credits if the income received consisted of dividends that were fully franked. Dividend imputation will be discussed below.

*Note that a share of any capital gains made by a trust as well as franking credit entitlements will also flow through to the various beneficiaries and be included in their personal tax return.