Tax and Structures

Individual taxation

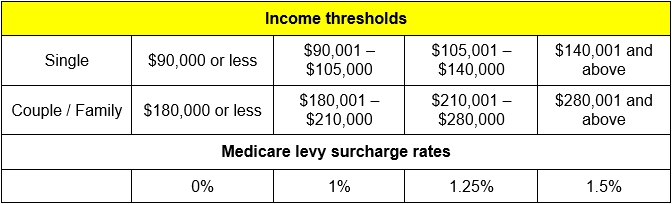

Medicare Levy Surcharge

An additional surcharge applies where private hospital cover has not been obtained by:

- Individuals who earn more than $93,000; or

- couples earning more than $186,000 combined.

Indexation of the income thresholds for the Medicare Levy surcharge were paused from the 2014-15 financial year. However, indexation will recommence from 1 July 2023 to the above thresholds.

The amount of surcharge depends on adjusted taxable income (ATI). The ATI includes taxable income, reportable fringe benefits and reportable super contributions paid by an employer, net investment losses and exempt foreign income.

Page 23 of 58