Tax and Structures

Taxable income

Taxable income example

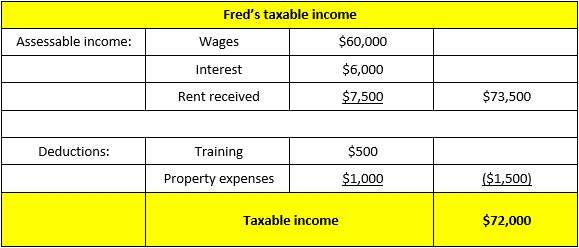

Here is an example on calculating taxable income:

Assume Fred (age 45) earns wages of $60,000 before tax, interest income of $6,000, rental income of $7,500 and he sold his surfboard for $400.

Fred also paid $500 to attend a training course relevant to his job, he spent $1,000 on repairing his investment property and bought a new fridge for his home for $900.

Fred’s taxable income is $72,000, as shown in the table opposite.

Note that Fred’s taxable income doesn’t include the cash from selling his surfboard or a deduction for buying the fridge – these are personal items.

Page 19 of 58