Tax and Structures

Individual taxation

Rebates

The gross tax payable may also be reduced by certain tax credits (also known as tax rebates), such as:

- low income tax offset

- spouse contribution tax offset

- pension and annuity tax offset

- senior and pensioner tax offset

- private health insurance rebate

- dividend franking credits

- foreign tax credits.

A tax offset reduces the gross tax you pay (known as your tax payable) on your taxable income. It is important to note that most tax offsets can only reduce the gross tax you pay to $0 (zero). Apart from the dividend franking credit which will be discussed below, you are not eligible for a tax refund because of a tax offset reducing your gross tax payable.

The low-income tax offset is briefly described below.

Eligibility for the low income tax offset (LITO) depends upon the level of taxable income. The maximum tax offset of $700 will apply if taxable income is $37,500 or less. This amount is reduced by 5 cents for each dollar for taxable incomes between $37,500 and $45,000, and then reduced by a further 1.5 cents for each dollar of taxable incomes between $45,001 and $66,667. The offset cuts out entirely once taxable income exceeds $66,667.

Taxpayers were also eligible for the low and middle income tax offset (LMITO) prior to the 2022/23 year.

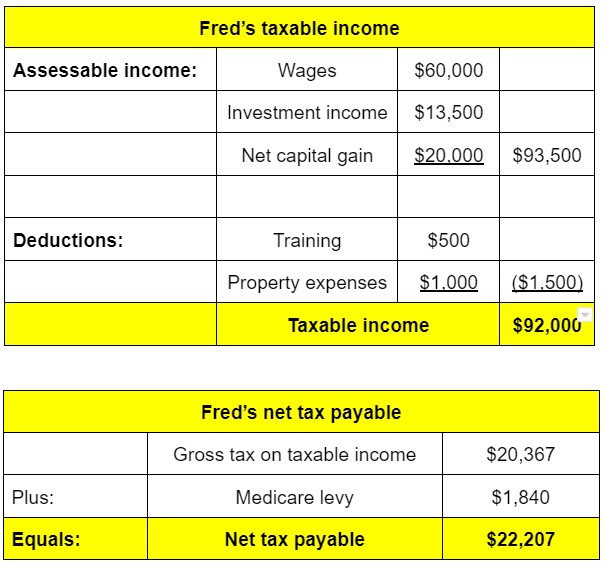

To recap on our example of Fred, we’ve calculated Fred’s assessable income and his ultimate tax payable in the table opposite for the 2023/24 financial year.