Tax and Structures

Comparison of all entities

Tax for a super fund

The capital gain for investments held more than 12 months is reduced by one-third, resulting in the taxable capital gain being $14,000 (2/3 x $21,000).

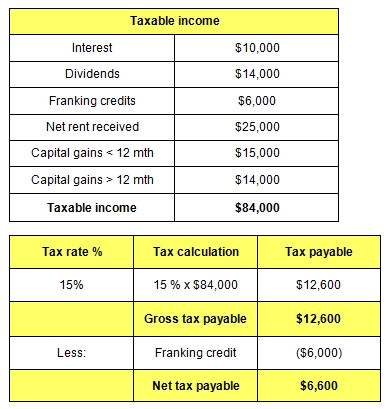

The taxable income for the super fund is summarised in the table opposite.

The tax for the super fund in 2023/24 of $6,600 is shown in the second table.

Note: There would currently be no tax to pay if the super fund was in the drawdown (pension) phase; this is further explored in the superannuation module.

In fact, if the super fund was in pension phase with a tax rate of zero, the franking credit of $6,000 will be refunded in cash to the super fund by the ATO and passed onto member balances.

Page 46 of 58